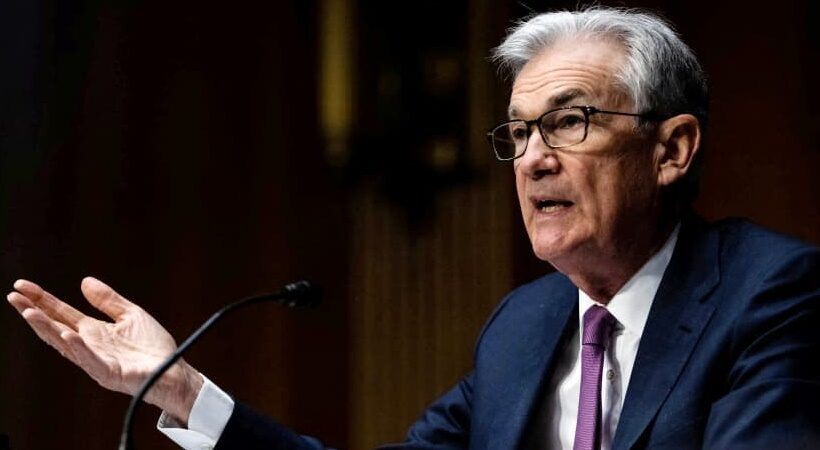

Jerome Powell, chairman of the Federal Reserve, appears to have reversed his previous position on the relationship between CBDCs and Stablecoins. In testimony to the US Congress, he suggested that the two could exist side-by-side, without the former replacing the latter.

Defending his position as chairman of the Federal Reserve and answering lawmakers’ questions about monetary policy as inflation rages, Federal Reserve Chairman Jerome Powell appeared before lawmakers Tuesday.

The basis for a Bank of the United States issued CBDC was discussed during Powell’s renomination hearing on Tuesday. Republican Senator Pat Toomey – a well-known crypto advocate – asked if a Fed-issued CBDC would prevent the existence of privately issued Stablecoins. Powell replied, “No, not at all”.

Read More: Meet The Billionaire CEO Who Wants To Give Up Vast Amount Of His Wealth

Powell has a much softer approach to Stablecoins than we heard last year. In July, he suggested that a CBDC’s primary benefit would replace crypto – including Stablecoins. Although Powell does not intend to ban other cryptocurrencies outright, the US regulatory approach differs from China’s.

Even so, Stablecoins are currently a hot topic among regulators. During a congressional hearing last month, both industry leaders and congressmen expressed conflicting views on the topic. The industry regards Stablecoins as a compliment to the financial system, but Maxine Waters believes that they could pose a threat to the dollar. There is even a suspicion that Stablecoins could be classified as securities.

If a CBDC existed, there are also questions about the practical utility of privately issued Stablecoins. However, the issuance of a CBDC appears far off. Powell previously stated that he would rather “do this right than fast,” leaving room for USDC, Tether, and Pax to succeed in its absence.

Inflation woes persist:

Powell reiterated his belief that inflation results from prolonged supply chain pressures and a weak labour market on the eve of the release of the latest Consumer Price Index (CPI) report.

It seems there is a mismatch between demand and supply. Powell said that we have a high demand in areas where supply is limited, including goods and automobiles. “Some of the solutions is the return of more supply.”

Powell said that central bank leaders had anticipated a faster return to the workforce, and no one assumed supply chain issues and bottlenecks would persist as long as they have.

Powell’s comments largely boosted markets, with the Nasdaq Composite rising as much as 1.16 per cent. Bitcoin and Ethereum also rose from recent slumps, rising 3% and 5%, respectively. Analysts warn, however, that the current economic situation leaves the long-term outlook uncertain.

In a recent note, Nicholas Colas, co-founder of DataTrek Research, wrote, “What we do not know is how the economy will respond to both the removal of rates from the zero lower bound and the Fed’s draining of liquidity from the financial system at the same time.”

However, forecasts predict that increases will occur soon. Goldman Sachs expects four rate hikes this year, and Oanda expects an 85% chance of the first increase occurring in March. Analysts say that risk assets’ future depends on when and how much interest rates are raised.

“After Powell signalled, he expects the Fed to begin normalizing policy this year, but that the decision on balance sheet reduction could take up to four meetings,” Edward Moya, senior market analyst at Oanda, wrote in a recent note.

As inflation increases, rates could rise faster, and the Fed may begin shrinking the balance sheet sooner, which could be bearish for risk assets like cryptocurrencies in the short term. Equities, however, could suffer more.